Is age just a number...

I saw a stat this week which showed that in seven years the age profile of Facebook has radically changed taking over 65s from a 6% minority to the largest single demographic cohort in 2021 at nearly 20%. In fact, the change within the older audiences in the main digital platforms shows high percentage increases throughout as the early adopters potentially move on and leave them to “mainstream” use.

So with the fast pace that our media behaviours are changing, can we still use age groups to paint a picture of our audiences habits and media consumption? As with most things, the answer is not clear cut and I think we can to an extent but there are some elements embedded in our brains which we first need to overcome.

Assumption is the lowest form of knowledge

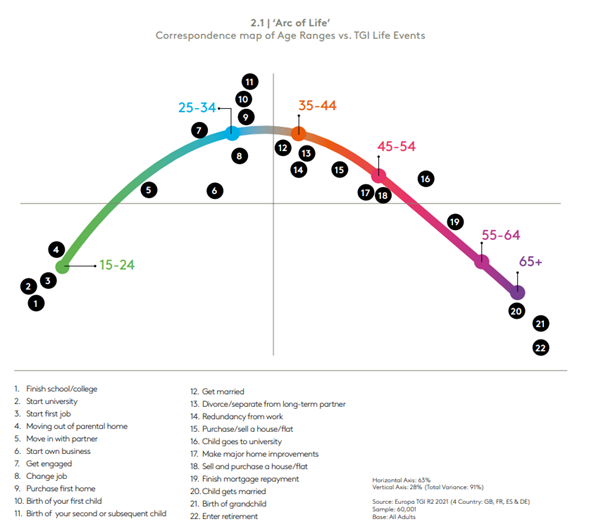

Kantar’s latest report ‘Beyond Age’ offers a new perspective on the understanding of age profiling in making your marketing more effective. A important chart in this report is the “Arc of Life” which shows age versus key life events such as moving home, getting married or having children. Milestones like these have always been crucial indicators for advertisers in sectors like home improvements and child related products to really understand when someone is most likely to engage with their brand. Society ‘norms’ are shifting so for example the average age to buy a house is 27 as is the birth of a first child. Marriage tends to come later at 34 and retirement is now standing at 67-68 which could be different to what you might assume. So assumptions are something we very much have to avoid in our media planning. What’s more, the importance of conducting in-depth research up front is becoming more and more vital as consumers are faced with ever-increasing ways in which media is delivered to them.

So what is age good for?

Age can still be a good predictor of attitudinal differences. For example, Kantar shows that people become more risk averse over time, and naturally prioritise fashion and career ambitions when they’re younger. The importance of what others think of them shows a significant decrease as people get older. This could be a positive depending on the impact this has on their attitude towards brands and how this affects their propensity to absorb and engage with them.

In some cases, over a range of attitudes, the results are very flat signalling that age is a poor differentiator. For example, the statements “How I spend my time is more important than the money I make” and “It is important to have a lasting relationship with one partner” do not change with age. It seems some beliefs remain embedded as part of who you are as opposed to how old you are.

What does mean for media consumption?

Taking those classed as Generation X (born 1965 – 1980) as an example, we discover significant diversity in the way they consume media demonstrating why they should not be approached as a single group.

‘Senior Sole Decision Makers’, for example, spend the most time with media and are the top segment for both live TV and internet use - at least two hours more per day than ‘Playschool Parents’ and ‘Empty Nesters’.

‘Senior Sole Decision Makers’ are also 81% more likely to be among the heaviest fifth of live TV viewers, while ‘Playschool Parents’ - tied up with childcare - watch the least live TV. And yet both ‘Playschool Parents’ and ‘Empty Nesters’ are above average readers of newspapers, relative to the average Gen X-er.

We can therefore see that life circumstances can and will have a significant bearing on category, product, and brand choice – even within a defined age group. Marketers seeking to optimise their campaigns will be well served by looking beyond age to better understand the range of factors that influence the choices of their potential customers. Effective marketing has always been about reaching the right people, at the right time, with the right message – it’s just become increasingly more complex for us to navigate through the plethora of ways to achieve this compared to when I first started media planning back in the day!